Managing Small Business Finances: What to Focus On

Becoming more familiar with your finances will lead to business growth. You’ll understand the health of your business, more easily identify opportunities, and have a process to navigate any issues that may arise. Learn why cash flow is vital to your business, how to create a cash flow forecast, and how accounting for a retail store: an ultimate guide for your store terms like burn rate and cash runway impact your business. Businesses often use either the accrual or cash methods of recording purchases. The accrual method puts transactions on the books immediately upon completing the sale.

- Before making a commitment, it’s essential to compare various financing options.

- Learn how to stay on top of your financial performance by reviewing your financial statements and comparing actual results to your forecasts.

- Proper financial management ensures that all obligations, especially tax-related ones, are met on time.

- For funding larger projects or business needs — like a renovation, equipment, or new marketing campaign — a business loan might be the way to go.

- Compliance with financial regulations is essential to avoid fines and legal issues.

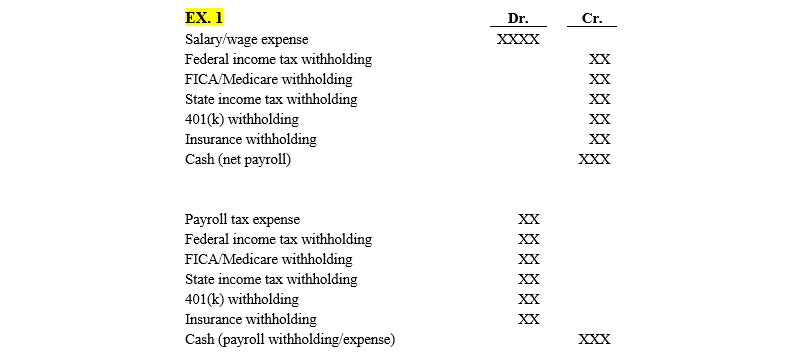

Setting aside three to six months’ worth of operational expenses can help tide your business over during financial snags. That’s a lot of cash to have on hand, but saving a little at a time, perhaps 10% of your income in a separate high-yield business savings account each month, can help what is payroll accounting you reach your goal. You can usually find one that offers free checks, no monthly maintenance fees and unlimited transactions. Check out our other guides to learn how to set up your finances and create valuable budgets and forecasts. These tips will help you reduce costs within your business, whether you’re well-established or just starting to grow. Luckily, you can strengthen your financial skills—even if you’re not a numbers person.

Know when to pay yourself

Dun & Bradstreet will seek out your payment experience from vendors and include it in your PAYDEX business credit score. The cash flow statement summarizes the movement of cash in and out of your business over a period of time. Analyzing your cash flow statement can help you determine how much cash you have available to pay bills and grow your business. Transparent and effective financial management fosters trust among investors, employees, and customers.

It’s also easier to pull up old documents in digital form than it is to dig through file drawers or boxes of old documents. Managing finances online with bookkeeping and payroll online programs helps you save time and monitor your money closely. That also increases the accuracy of your numbers and minimizes the risk of human error. Some types of businesses are overwhelmed with excess inventory, while others are trying to keep up with a surge in customer demand.

Knowing exactly how much comes into your business helps you budget and ensure you have enough to cover your business expenses. Some business owners still use the traditional spreadsheet method, while others prefer the more updated online software option. The same goes for credit cards if you plan to use them to cover business expenses. At tax time, you don’t have to sort through all of the expenses and income to figure out which belongs to your business. Budgeting, accounting, forecasting, tax planning, risk management — these are important aspects of managing your business finances as part of a comprehensive financial plan.

Consider an accounting professional.

Regular financial oversight helps you identify areas of growth and waste. You can maximize returns by focusing on profitable activities and reducing unnecessary expenses. Getting your business finances right is crucial for starting a business. You also want to select a pay schedule that follows all state guidelines, and gives you and your team the most financial autonomy.

Everything you need to know about cash flow

When you start with one or two employees, handling payroll yourself may be doable. As you add more employees, payroll becomes more time consuming, which pulls you from duties that help generate income. When you think of your time as money, the increased time you spend on payroll costs your company money. Switching to payroll online or outsourcing payroll work can save you money. Keep in mind that not all credit card companies and vendors report payments to the business credit bureaus. If you’ve been making on-time payments and they haven’t been submitted, consider signing up for Dun & Bradstreet’s CreditBuilder product.

When you incorporate your business, you legally make it a separate entity so it’s independent of you. This option requires more work to establish, and you have greater accounting responsibilities. Supply chain disruptions and volatility have impacted retail, restaurants, and healthcare. Stay one step ahead special revenue fund of your inventory levels by using inventory management software that automatically connects your in-store and online catalogs.

There are endless options out there for small business financial tools. Some, like loans, can help you get the capital you need to grow your business. Others, like small business credit cards, can be useful for making regular, periodic business purchases and earning rewards. Efficiently managing your business finances is fundamental to achieving sustainable growth and maintaining a competitive advantage.