Jumbo financing home loan book: Jumbo mortgage limitations and needs

Jumbo financing restrictions

Jumbo loans are generally obtainable in quantity around $2 or $step three mil. Additionally the requirements so you can qualify for an excellent jumbo mortgage be informal than just they used to be. If you’re planning to acquire a leading-charged home and you may consider you might need good jumbo www.paydayloansconnecticut.com/hartford mortgage, this is what you need to know.

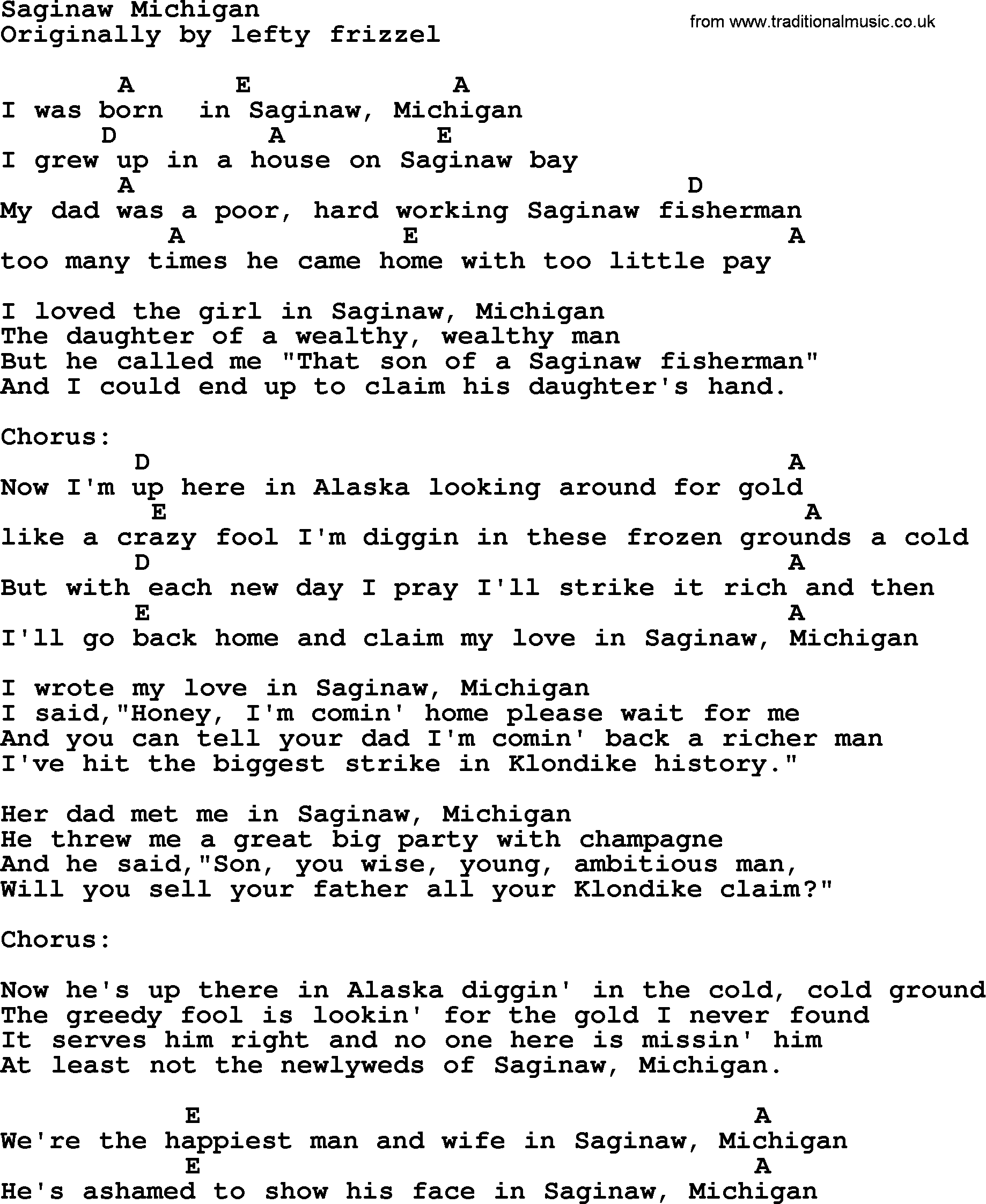

What’s an excellent jumbo loan?

A beneficial jumbo mortgage is actually any financial that’s more than the regular conforming mortgage constraints set by Federal national mortgage association and Freddie Mac computer. Inside the 2024, good jumbo financing was a home loan bigger than $ in most elements. Though loan restrictions was higher in more costly counties.

These types of financial is normally entitled a great non-conforming financing whilst exceeds conforming limits. Buyers thinking of buying a luxury domestic or a property for the a high-rates real estate market might need a beneficial jumbo mortgage to invest in their residence.

Are there jumbo mortgage limits?

As they are low-conforming, jumbo money don’t possess limitations place because of the Fannie or Freddie. Rather, mortgage brokers will set their jumbo financing constraints. Eg, in the course of this composing, Skyrocket Mortgage considering jumbo loans as much as $2.5 million when you are loanDepot invited jumbo financial amounts up to $step 3 million.

Put differently, each person lending company can get its jumbo mortgage limit. Thus home buyers from inside the ultra highest-costs section hoping to get multi-million-buck qualities will have to pick local lenders you to definitely concentrate on high-equilibrium jumbo fund tailored to their field.

What exactly is noticed a good jumbo financing for the 2024?

While it began with , conforming mortgage limitations enhanced . Constraints getting a single-home today go of up to $ in the most common of the country. They are even higher in the high priced locations like any from Ca, each one of New york, the fresh new Region from Columbia, Alaska, and The state: up to $ to own one-family home. Fund that exceed these conforming limitations are believed jumbo loans.

In case the requested loan amount is actually above $ , the qualified financial support was influenced by brand new condition mortgage limitation on domestic we want to pick, shows you Robert Killinger , an elder financing administrator with Financial System in Danvers, Massachusetts.

For example, he states, in the Eastern Massachusetts, the brand new condition financing limitations wade as high as $770,500. When you need to pick property indeed there and need so you’re able to use $800,000, you will most certainly need an effective jumbo home mortgage.

Compliant versus jumbo loan limits

While the jumbo financing was over the compliant loan maximum set from the the latest Government Houses Money Service (FHFA), he or she is classified just like the low-conforming.

You to non-conforming name matters for individuals. While the non-compliant financing, jumbo mortgage loans aren’t entitled to buy from the Fannie mae or Freddie Mac, the fresh new providers you to put credit conditions for many home loans.

Since the jumbo fund try not to slide within this Fannie and you may Freddie’s legislation, loan providers arrive at lay their unique criteria. That means that guidance to own borrowing from the bank, money, advance payment, or other very important qualifying affairs can vary in one bank to next.

Generally, non-compliant fund encompass far more tough assistance to own certificates, says Jon Meyer , The borrowed funds Accounts loan pro and authorized MLO.

When you’re in the market for a pricey household and you will a great jumbo loan, make sure you check around and find a lender that fits your needs.

Jumbo loan standards from inside the 2024?

Jumbo loan criteria be more strict because this kind of financial sells a greater chance in order to loan providers. However, home buyers must not proper care a lot of. Anyone with sufficient monthly money, borrowing, and you will down-payment is also be eligible for good jumbo mortgage , notes Bruce Ailion , a realtor and you can home attorneys during the Atlanta.