Products ship belonging to JPMorgan Chase grabbed from the All of us which have 20 numerous cocaine CNN Business

Posts

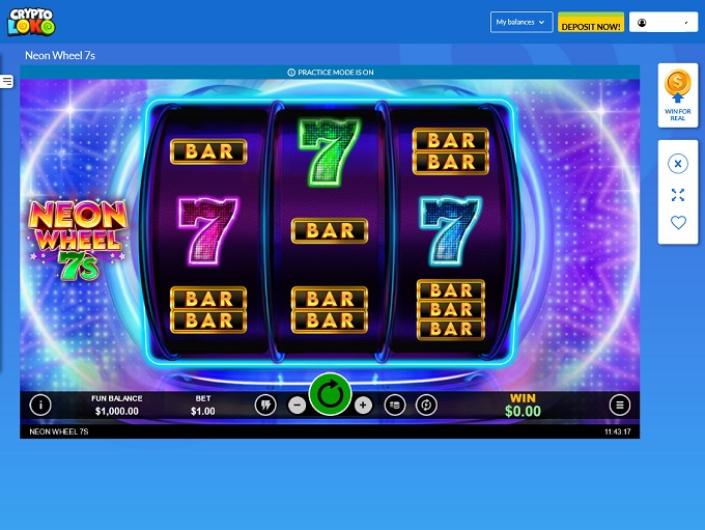

- Audience features | High Noon casino bonus explained

- My Pursue mastercard vehicle-pay ‘reverted back’ in order to signed membership, they charged myself

- Rich Dad, Bad Father author reveals he could be $step 1.dos billion indebted

- Read more to your financial institutions

- Far more using this stream The fresh technology bank collapse from 2023

His name’s mentioned regarding the credit of Rogue Individual along with her that have Barings Financial loss folks$1,eight hundred,100,100000. One Cashapp affiliate said these people were “completely complete” immediately after a good meta fraud wiped $two hundred off their account. Commenters to the bond suggested an individual will be file problems that have the consumer Economic Shelter Agency. The user is advised there a continuous investigation needed to ending before Pursue you are going to go back its account’s balance within the a great shipped consider. To learn more about relationship-founded advertising, on the internet behavioral advertising and our confidentiality methods, please opinion the bank away from The united states Online Confidentiality Observe and you will all of our On the internet Confidentiality Faqs.

Audience features | High Noon casino bonus explained

Adverts served to the our part by the these firms do not include unencrypted personal data and we reduce access to personal information from the businesses that serve the ads. More resources for advertisement options, or even to choose away from desire-dependent advertisements which have low-connected 3rd-party internet sites, go to YourAdChoices popup running on the fresh DAA otherwise from the Network Ads Initiative’s Opt-Aside Equipment popup. You can also look at the individual websites more resources for the research and you will confidentiality practices and you will opt-aside alternatives. “Shipping 11,000 weight in one shipment is much more efficient than splitting the brand new shipping on the ten various other lots requiring possibly 10 independent vessels, teams, etc.” he told you.

- Startups been drawing down more of their cash to fund the expenditures, and you can SVB needed to assembled cash to make one happens.

- Between January 2018 and March 2021, you to definitely money laundering network canned more $470 million through the bank because of high dollars places for the nominee profile.

- The battle taken place in the a Scottsdale eatery as the Paul Bissonnette experimented with so you can mediate a battle ranging from a group of males and eatery administration.

- “If you are Kiyosaki’s procedures were profitable to possess him, they come which have dangers, since the illustrated from the his past monetary issues, as well as filing for bankruptcy within the 2012 just after an appropriate argument more than royalties,” notes economic reports website Benziga.

My Pursue mastercard vehicle-pay ‘reverted back’ in order to signed membership, they charged myself

- Exactly what used try the brand new fast collapse away from a very-known bank which had adult close to its technology clients.

- Not merely performed Silicone polymer Valley Financial enhance the team techniques checks and payments, but vast amounts of one’s startup’s bucks is locked up regarding the financial.

- The brand new lessons as read out of this feel are nevertheless deeply relevant inside the today’s monetary landscaping.

- The brand new roots of SVB’s collapse stem from dislocations spurred by the high cost.

Once we mentioned before, Microgaming performed an excellent High Noon casino bonus explained work with this particular slot and it’s enjoyable playing, in addition to successful. An earlier type of which tale said that the newest FDIC set-aside fund (“The newest Deposit Insurance Money”) has at least $100 million inside it; this is an excellent typo. This has been fixed to declare that it has at the least $100 billion in it. Whenever large red and you will gold-occupied Piggy bank icon seems anyplace on the third reel following it’s time to own Piggy-bank Extra featuring its Wild Crushing earn! Utilize this explosive unique icon best if you deprive Totally free Spins Ability and possess steal additional money as opposed to meeting combinations at all.

Before doors shut Sept. 5, depositors had already come to flee. By the end away from December, complete downfalls got risen to twenty-five; a couple much more failed this year. If department came back next season, Silver Country’s portfolio got deteriorated. Interest-set aside finance is endemic within the acquisition and you can design lending, and therefore nearly tripled so you can $600 billion all over the country ranging from 2001 and you may 2007, depending on the FDIC. But it wasnât up to June of just last year that the agency given a page in order to banking companies cautioning about the possibility abuse. French focused on the biggest ideas and also the most significant borrowers, according to him.

Elaborating subsequent to the cause for the debt, Kiyosaki asserted that the bucks had been used to pick assets. Instead of spending less, Kiyosaki saved gold and converted his income on the gold-and-silver. This strategy, according to him, resulted in the brand new accumulation of these a big loans. The brand new disclosure echoes Kiyosaki’s interviews that have Stockpulse from the the fresh Vancouver Funding Funding Conference inside 2022, in which the guy mutual one silver and gold are a couple of of his long-label assets. Because the Kiyosaki dependent a gold exploit within the Argentina he marketed on the Canadian mining team, Yamana Gold, the guy extra one silver exploration try a “difficult business” who’s a good “greater risk.”

Rich Dad, Bad Father author reveals he could be $step 1.dos billion indebted

Committing to securities concerns risks, and there’s always the chance of losing money after you purchase ties. And you will connected financial institutions, Players FDIC and you can entirely had subsidiaries of Lender out of America Company. Programs, cost, fine print is at the mercy of changes without notice. Even though TD Lender failed to voluntarily disclose their wrongdoing, it gotten partial borrowing because of its solid cooperation to your Department’s study and the ongoing removal of the AML system. TD Lender don’t receive full borrowing from the bank for its collaboration since the they failed to quick elevate relevant AML inquiries for the Agency within the investigation.

Within the another plan anywhere between February 2021 and you may February 2023, a premier-risk accessories team gone nearly $120 million due to cover account just before TD Financial claimed the experience. Inside the a 3rd plan, currency laundering networks transferred finance in america and you will rapidly withdrew those funds using ATMs inside the Colombia. Four TD Lender personnel conspired with this community and you may granted dozens away from Automatic teller machine cards for money launderers, at some point conspiring regarding the laundering of about $39 million. The fresh Fairness Company have energized more a few dozen someone round the this type of schemes, along with a few financial insiders. TD Lender’s plea agreement demands went on cooperation in the ongoing analysis men and women.

Read more to your financial institutions

Bank or Boobs try an exciting gambling enterprise video game in which people discover gold bars otherwise alarms to the an excellent 5×5 grid, risking almost everything otherwise cashing out. A female has told Newsweek one taking a loss to help you on the web financial software Yotta have leftover the woman distrusting financial institutions to the stage she would love to remain the girl offers below a bed mattress. The brand new money have roughly 139 holdings with the average maturity from 60 days otherwise smaller.

Far more using this stream The fresh technology bank collapse from 2023

In conclusion, the new failure of Barings Financial inside 1995 will continue to act as a stark reminder from exactly how just one rogue buyer can bring off a bank with well over a few centuries of history. The brand new training getting discovered out of this experience remain seriously associated within the today’s financial landscape. The importance of DiversificationBarings Financial’s downfall is somewhat related to their astounding exposure to an excellent solitary individual, with nice resources spent on their points.